The CCI Indicator

It’ll take you no time at all to figure out that the Commodity Channel Index – popularly known as the CCI – was originally developed for commodity trading. It was developed back in the 1980s, at a time when spot forex trading wasn’t even a thing, to help commodities traders identify changes in long-term market trends. However, as anyone and everyone in the social media forex sphere (and beyond) will tell you, it isn’t used just for trading in commodities and forex traders regularly make use of its adaptability to hammer it into several different roles.

CCI Breakout setups

Of the three most common uses for the CCI, hunting down breakouts from low or high bases is probably the most workable. The neat thing about this approach is that it works on a greater variety of timeframes, making it more appealing to a broader range of traders. The crux of the strategy is to wait until the market enters a high or low base (i.e. it goes sideways and forms a base after a strong movement upwards or downwards). Here the hope is that a signal from the CCI will confirm that the price is about to break out of the base and continue its previous movement.

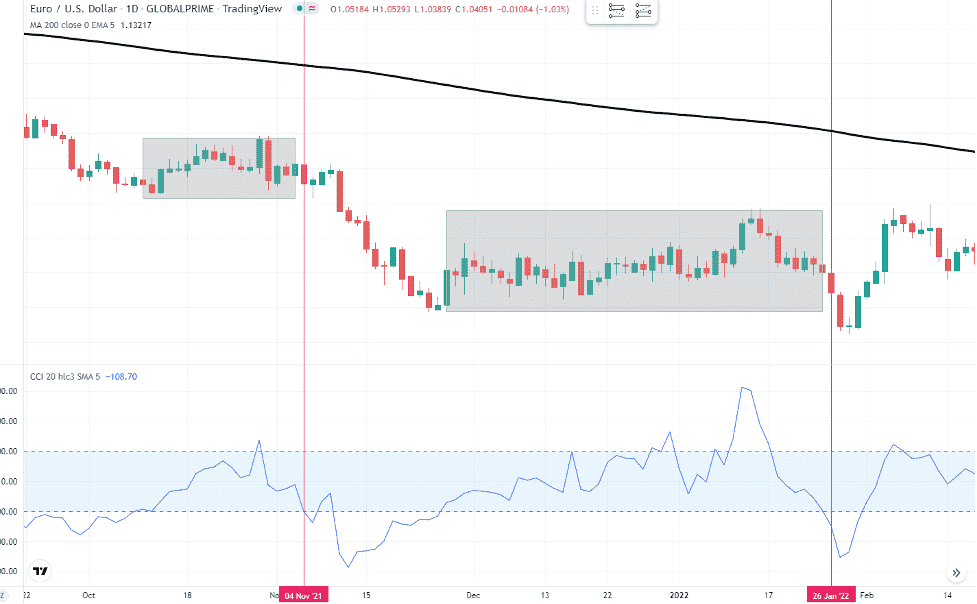

1 CCI breakout strategy on EURUSD Daily timeframe. Source: TradingView

In the picture above we see CCI on default settings signaling short breakout entries after consolidation periods marked with gray rectangles. The first entry was a successful one when the CCI broke below -100 (band). The second probably failed depending on your target profits, however, note the CCI indicator found a signal before the price broke the lower consolidation level in both cases. Remember that CCI is originally designed to find strong momentums and not overbought and oversold levels.