The ADX Indicator review

All that glitters is not gold, they say. The same often applies to everything that is popular. And, if nothing else, ADX is one of the more popular indicators on the market.

The average directional index (ADX) was developed more than 40 years ago. Nowadays, this tool is typically used by technical traders to measure volume. ADX consists of two main components – the ADX line and Directional Index (DI). The indicator aims to show trend strength and trend direction.

Traders’ Conclusions and Opinions About the ADX

Based on the performance of this indicator alone, these 3 points are very common when we read about ADX on trading community forums:

- ADX should only be used with higher time frames because it tends to give false information on lower time frames.

- The ADX tends to lag and the volume meter is generally very slow, which can lead you to enter the market too late.

- The strategies used with the traditional ADX alone are insufficient and can offer a lot of false signals, but the ADX indicator can be used with other tools to obtain better signals.

So, it seems the ADX in its original iteration is just not enough as a standalone strategy. The ADX indicator does not show easily observed practical value unless combined with other indicators.

ADXm – Attempt to Improve the ADX

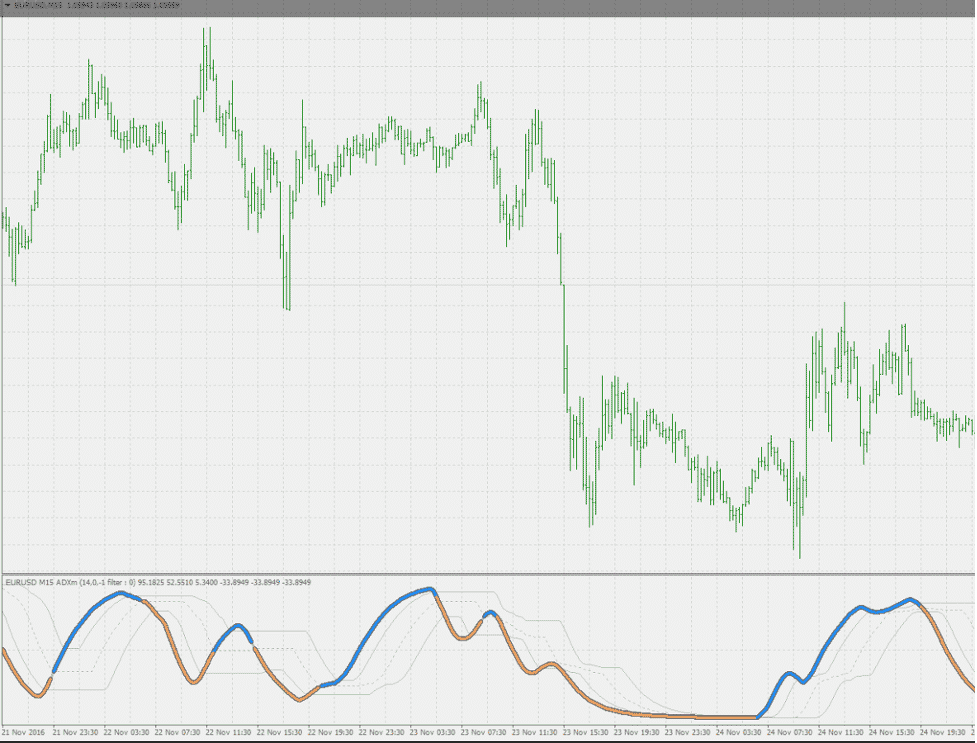

Unlike the traditional ADX indicator, which makes it hard to see where the market is headed, ADXm clearly shows both positive and negative ADX half-waves (colored parts of the line in the chart below).

ADXm features additional price calculation options. While the traditional ADX offers no price options (i.e. it uses fixed close, high, and low for circulation), ADXm allows traders more freedom to adapt the indicator.

1 ADXm improved clarity and precision over the traditional ADX. Source: forex-station.com